By Deron T. McCoy, CFA®, CFP®, CAIA®

Chief Investment Officer

Summertime is meant for family vacations and lazy days at the pool or beach and hopefully a few weeks removed from the constant stream of negative news that dominates our daily lives. But unfortunately, the news cycle doesn’t end, and we wouldn’t blame you if were a bit weary-eyed after the events of the summer as the actors and actions in and around Washington DC kept the nightly news cycle going at full speed. We will leave it up to MSNBC and Fox News to tackle partisan US politics, but now US finances are taking center stage as well. Why is that?

THE SIDESHOW

It is no secret that the US Budget does not function like yours or mine. We need to balance the budget at the end of the day whereas the US government has not had to—at least not yet. But that is a good thing as in periods of recession, war, or pandemics, the US government can run deficits to improve economic prospects or confront enemies—or both as was the case in 2020. Once the landscape improves, the deficits can be reduced or repaid in an improving fully employed economy with corresponding higher tax revenues. This is not new news. However, what is new news is that while the annual deficit started to recover post-pandemic, it has now u-turned and is headed higher—all in an environment of decent GDP growth and a sub-4% unemployment rate.

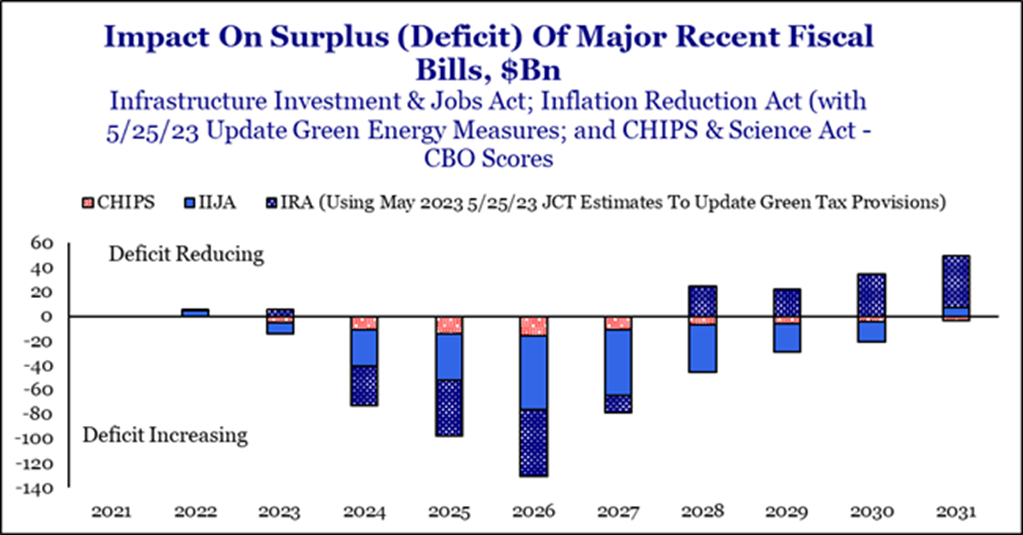

Want more good news? The spending looks to continue in the years ahead as the three cornerstones of Biden’s agenda (Infrastructure Investment & Jobs Act, Inflation Reduction Act, and the CHIPS & Science Act) further increase the deficit in the next few years before reducing the deficit towards the end of the decade.

Source: Straregas Research Partners

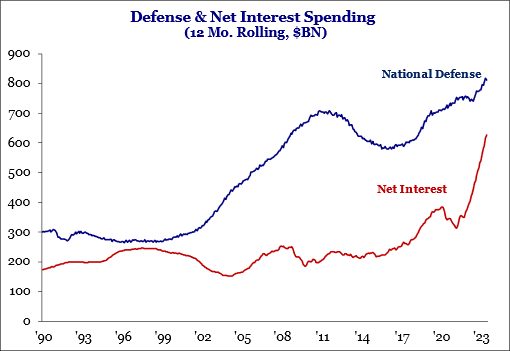

It comes without question that when aggregate debt levels rise, the cost to service that debt rises as well. But not only does the US have more debt to service, the level of interest rates to service that debt has risen as well adding insult to injury. With the country’s short-term interest rate now 5.5% higher than it was a mere 18-months ago, debt servicing costs have exploded higher and are now approaching budgetary line items such as National Defense.

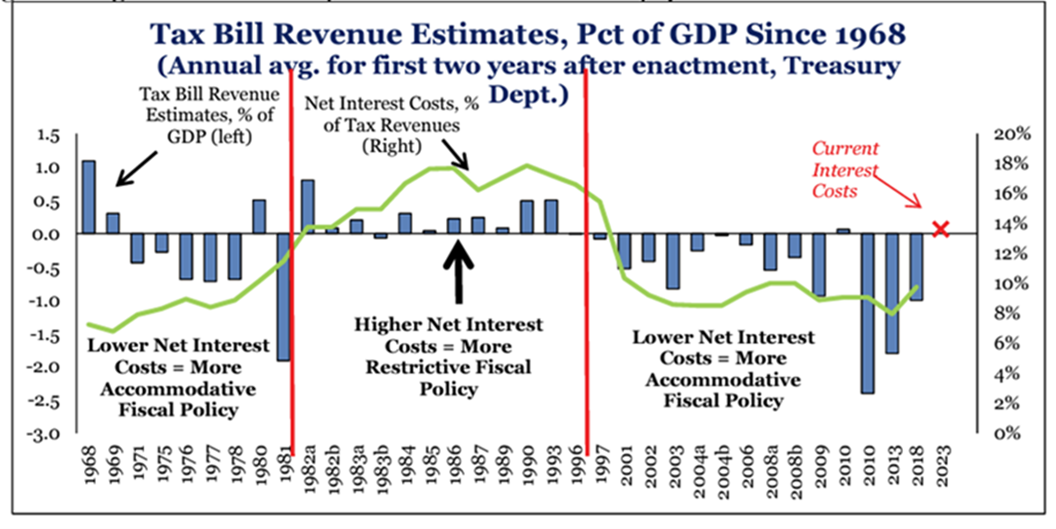

What does this all mean? According to Strategas Research Partners, if we use history as a guide and analyze Interest Costs as a Percentage of Tax Revenue, we see that the US is soon approaching the point in which austerity becomes the landscape as fiscal policy becomes more restrictive (for some that may be hard to imagine as the last time the country was in such a predicament, Tiger Woods was still an amateur while Steve Jobs worked for NeXT—and several inventions had yet to hit the market including the camera phone, the MP3 player, Wi-Fi as well as both Hotmail and MySpace!).

Source: Straregas Research Partners

Fiscal austerity may come in the form of more taxes or less spending—or perhaps a little bit of both. But how do politicians in today’s partisan world get rational policy across the finish line? Well unfortunately for the rest of the world, it sometimes comes down to brinkmanship, as witnessed in the debt-ceiling negotiation from earlier in Q2. And look for this to continue. Heading into early Q4 be on the lookout for a potential government shutdown as Congress further negotiates and draws out this ongoing saga. Sandwiched between these two congressional events was the Q3 summer news headline in whitch the bond rating agency Fitch downgraded US Treasury bonds. But why exactly did they downgrade US debt? It’s going to sound familiar as they considered the following:

- Fiscal deficit deterioration over the next three years: According to Jeffrey Gundlach, the CEO of DoubleLine, our “budget deficit is near 9% of GDP in an economy not viewed as being in recession. That means if a year ago we actually balanced the budget, GDP would have been near -6% the last twelve months.” If the country does hit an economic soft patch or recession, there is potentially less forthcoming stimulus which “would increase America’s vulnerability to future economic shocks.”

- Fiscal debt deterioration over the next three years: Rapidly growing annual deficits lead to a larger aggregate debt burden—currently forecast to reach 118% of gross domestic product by 2025 (more than 2.5x higher than readings from other countries rated AAA near 39.3%, according to Reuters).

- Political deterioration and erosion of governance related to peers: Bringing it all together, not only did Fitch downgrade the US based on quantitative data outlined above, but it also based its decision on more qualitative data including how we function as a society namely the repeated down-to-the-wire debt ceiling negotiations that threaten our government’s ability to pay its bills as well as our heightened political polarization reflected in part by the ‘events’ of January 6th.

Unfortunately, politics and Washington DC take center stage and are the focus of our 24-hour news cycle. But fortunately, bad politics doesn’t necessarily translate into bad news for investors. Instead, wise investors will focus on the news most applicable portfolio construction—namely interest rates, inflation, valuations, and economic growth.

THE MAIN EVENT

Consider the last three items listed above. We noted a year ago (when the S&P 500 was about 1000 points lower) that long-term investors should welcome 2023 because not only was the landscape changing in favor of the investor including a peak in inflation with lower valuations, but also that in no time in history had the US entered recession in the third year of the upcoming presidential term. And here we are. No recession this year as the flashing-red economic recession scare from Q2 looks to have been downgraded to a flashing yellow and perhaps pushed back to 2024. Recent upturns in several data points including but not limited to housing, autos, productivity, and manufacturing construction are all welcome signs for those hoping for a soft-landing. Recent Q2 weakness in jobs has U-turned as well. While historically stress in the banking sector (which we witnessed earlier this year) has led to an increase in unemployment, that day has not yet arrived. Still-healthy job and income gains point to an economy capable of weathering a period of rapid interest-rate increases aimed at thwarting high inflation. That’s also contributing to renewed confidence among consumers, which may bode well for spending—a nice tailwind that will help to counteract the upcoming headwind of the return of student loan repayments that will hit millions of borrowers later this year.

But unfortunately for Wall Street, strong employment growth comes with its own problems. A tight labor market empowers employees over employers—leading to larger than normal wage gains at this point of the business cycle. Excessive wage gains not only crimp employer profits but also can lead to inflation as more money sloshes around the system. And that is exactly the problem the Federal Reserve is trying to solve—inflation. And while significant progress has been made over the last year, unfortunately for the Federal Reserve, inflation may U-turn and increase here shortly as the easy month-over-month comps to 2022 are now in the rear-view mirror.

As you can see, the growth-inflation-interest rates pathways are intricately interconnected, and we are at a spot in the business cycle where the crosscurrents are sending mixed signals. The data these next few months are extremely critical as it will confirm whether we are at an inflection point or whether growth, rates, and the business cycle can continue to march higher into next year.

THE MAIN EVENT NOW INCLUDES CHOICES

But in a rare win for investors, this cycle comes with choices. Let’s briefly dive into the math behind stock and bond investments. One normally measures stock valuations by their Price (P) relative to the Earnings (E). The resulting P/E ratio is commonly used among investors. But we can also take the reciprocal E/P to see what a company’s earnings yield might be. In the case of the S&P 500 trading near a 20 P/E, it can also be said that investors get a 5% earnings yield based on today’s prices (the reciprocal of 20 is 1/20 which equals 5%). Why do we bring this up? Well, we can also analyze the earnings (or income) from a bond relative to its price as well. With bond income relative to price (again E/P or more commonly known as ‘yield’) above 5%, investors in today’s investment landscape have choices on how to generate 5%+ returns which stand in stark contrast to the years of paltry yields during the last cycle.

Furthermore, if an investor adds corporate risk (commensurate with corporate equity risk found in stocks), yields climb even higher. Furthermore, if investors sacrifice some liquidity one can generate near equity-like historical returns offering an abundance of investment choices for today’s investor than that of yesteryear. While economic trends have improved over the summer, elevated stock valuations alongside elevated yields argue for a truly diversified approach with portfolio hedges that can offset one another no matter what next year’s turbulent news cycle and presidential election holds.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit www.signatureia.com/disclosures. Signature Investment Advisors, LLC (“SIA”) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Signature Estate Securities, Inc. member FINRA/SIPC. Investment advisory services offered through SIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323.