By Phillip Argue,

Director of Investment Strategy

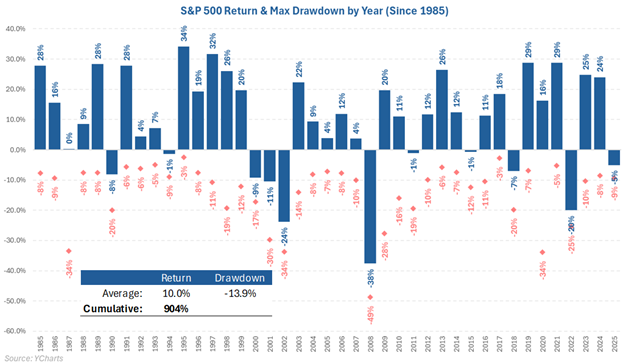

After two years of relatively smooth market conditions, volatility has returned. This shift is unsettling, especially when we consider how strong the market has been over the past two years—the S&P 500 gained 25% in 2023 and another 24% in 2024, with the largest pullback being only 10%.

Currently, the source of volatility stems from “potential” policy changes under the new administration. I emphasize “potential” because many of these policies are still in flux—some haven’t been enacted yet, and others may serve as bargaining chips in future negotiations. Regardless, the market doesn’t like uncertainty, and the S&P 500 has fallen 9% (as of 3/11/25) from its mid-February peak.

The Policy Landscape: Growth vs. Risks

Since the election in November, there have been two distinct sides to the President’s policies: tax cuts and deregulation, which are generally positive for economic growth, and spending cuts and tariffs, which pose potential risks. Over the past month, the focus has leaned more toward the latter. However, it’s important to remember that during Trump’s first 30 days, the S&P 500 logged five new all-time highs. The prioritization of policies will likely shift over time.

There are three key questions that will determine the future path of financial markets:

- Do these policies push the U.S. economy into a recession?

- If not, do they hurt corporate earnings?

- How do they impact interest rates?

Recession Probabilities: Key Economic Indicators

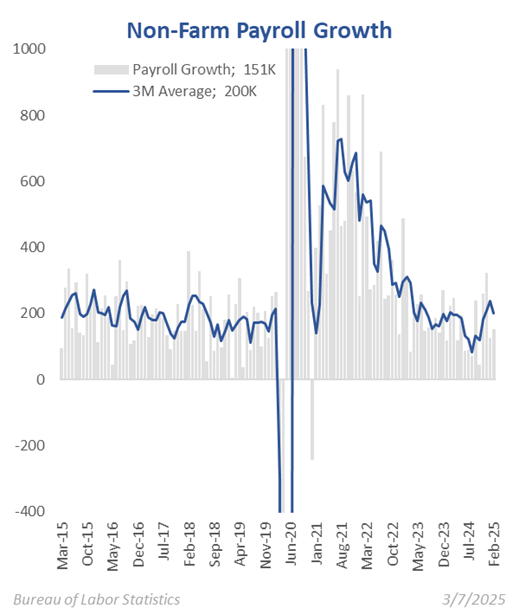

The U.S. economy was showing strong momentum heading into 2025, and that positive economic in

ertia puts the country in a better position today to absorb policy changes than six months ago. As consumer spending largely drives the U.S. economy, the labor market is the key variable to monitor. Histor

ically, recessions have been tied to negative job growth, and so far, there are no signs of this occurring:

- Payroll growth has averaged 200K new jobs over the last three months (up from 118K in October).

- Job openings are up 600K over the past four months.

- Initial jobless claims remain low at 221K, well below October’s high of 260K.

- Average weekly hours and overtime hours are both on the rise since October.

While the headlines may fuel fears about potential changes, the actual economic data doesn’t support a recession scenario—yet. We continue to monitor every indicator closely, but prudence dictates that we avoid speculating on policy headlines until they manifest in real data.

Corporate Earnings: Resilient Despite Uncertainty

The latest earnings season for Q4 2024 (ended in December) revealed a 10% year-over-year increase in earnings. Although there was some disappointing guidance, analysts haven’t adjusted their full-year estimates for 2025 significantly. The S&P 500 is expected to earn $267 in 2025, down only 1.5% from December forecasts. This minor revision is not uncommon, as analysts typically adjust estimates throughout the year.

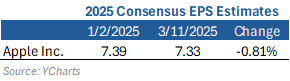

Due to the unpredictable rollout of tariffs, analysts may be finding it difficult to quantify their full impact on earnings. Consider this – there are 45 analysts who publish earnings estimates for Apple. Keep in mind, most Apple products are made in China, and the US has implemented two additional 10% tariffs on all goods made in China. Since the start of the year, there has been essentially no change in Apple’s expecting earnings this year.

If tariffs were going to negatively impact corporate earnings, we’d expect Apple to be ground zero. So far, the people who know the company best don’t see a material impact.

Interest Rates: The Impact of Fiscal Policy and Tariffs

The 10-year Treasury yield peaked in mid-January at 4.8% and has since declined by half a percent to 4.3% (as of 3/11/2025). Part of this decline stems from growing recession fears, but it also reflects expectations that government spending cuts will lead to smaller deficits and fewer bonds being issued in the future (reducing supply).

While we anticipate a smaller government in the coming years, the extent of that reduction remains uncertain. A smaller deficit, however, should help lower interest rates, assuming other factors remain constant.

Conversely, tariffs are expected to increase prices, as they function as a tax on imports. The true impact on overall inflation remains extremely uncertain, as proposed tariffs are subject to change and will affect different sectors to varying degrees. We take comfort in the fact that even with tariffs being announced, treasury yields are still well below their peak of 5% in October 2023.

Positive Signs Amidst Volatility

Despite the volatility, there are some encouraging signs. For example, mortgage rates have fallen from 7.0% at the start of the year to 6.6%, and mortgage applications have increased by 30% in the first two weeks of March.

While 2025 has brought increased volatility, it is primarily driven by what “might change,” not by what “has changed.” While recession fears have risen, they are not supported by economic data, or revisions to earnings estimates. We will continue to look for tangible signs that policy actions are making their way into real data and adjust accordingly. Until then, we view the recent bout of volatility as simply a return to normal after two very good years for equity investors.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Investing in securities carries a risk of loss, including the potential loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. The information contained herein was carefully compiled from sources SEIA believes to be reliable, but we cannot guarantee the accuracy or completeness of the information provided. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit www.signatureia.com/disclosures. Signature Investment Advisors, LLC (“SIA”) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Signature Estate Securities, LLC member FINRA/SIPC. Investment advisory services offered through SIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323.