By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

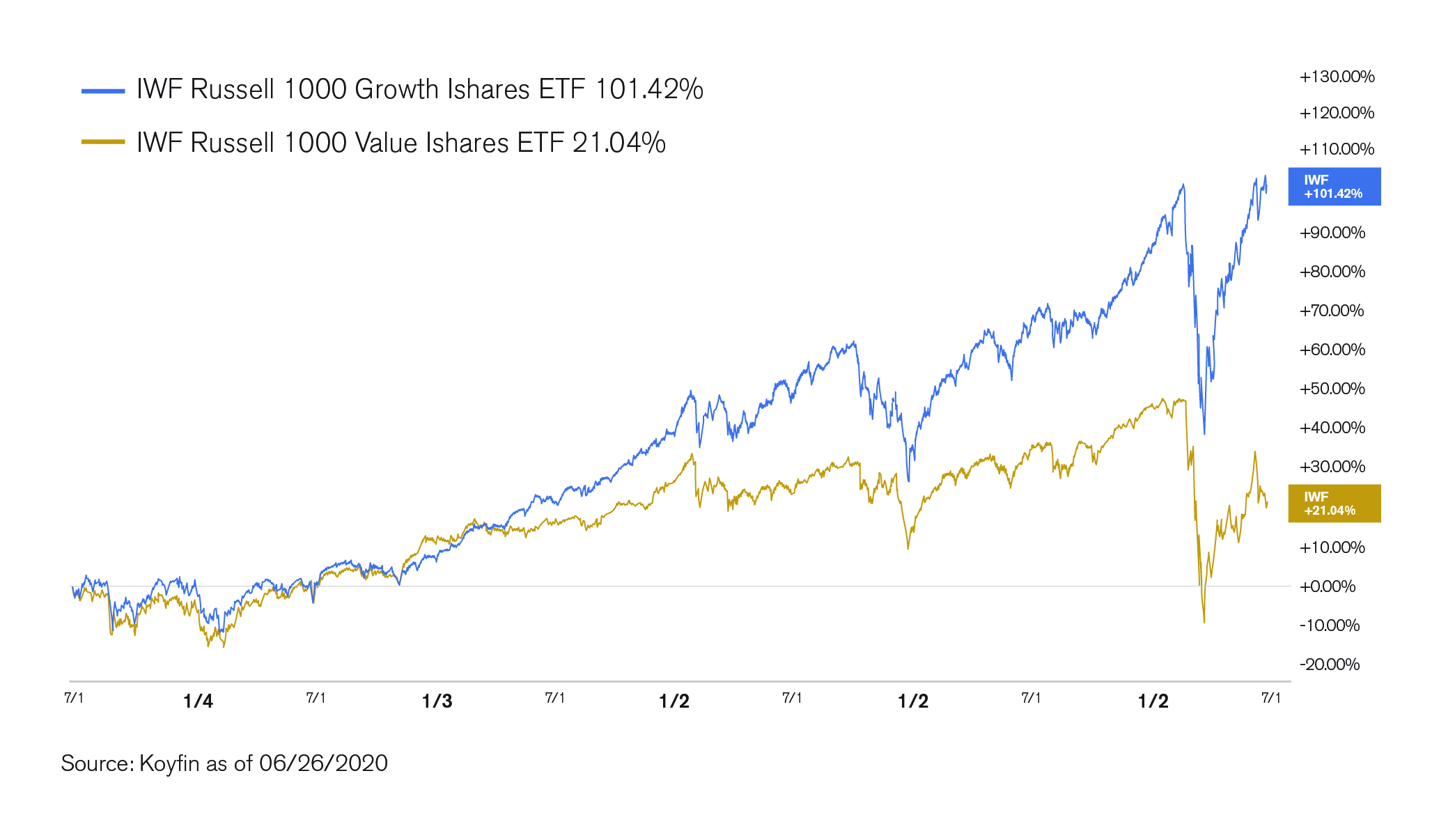

As we entered the decade of the 2020s, top of mind for many multi-asset class investors was (and still is) the eye-popping performance of mega cap growth stocks – not only in absolute terms, but especially relative to other sectors and asset classes that have served as a drag on performance, namely value. Investors naturally question how long this dominance of Growth vs Value can continue, and wonder whether or not they should throw in the towel on “old economy” value stocks that have hampered their portfolio returns.

Exhibit 1: Trailing Five Years Performance of Russell 1000 Growth and Russell 1000 Value

Why should you continue to invest in Value?

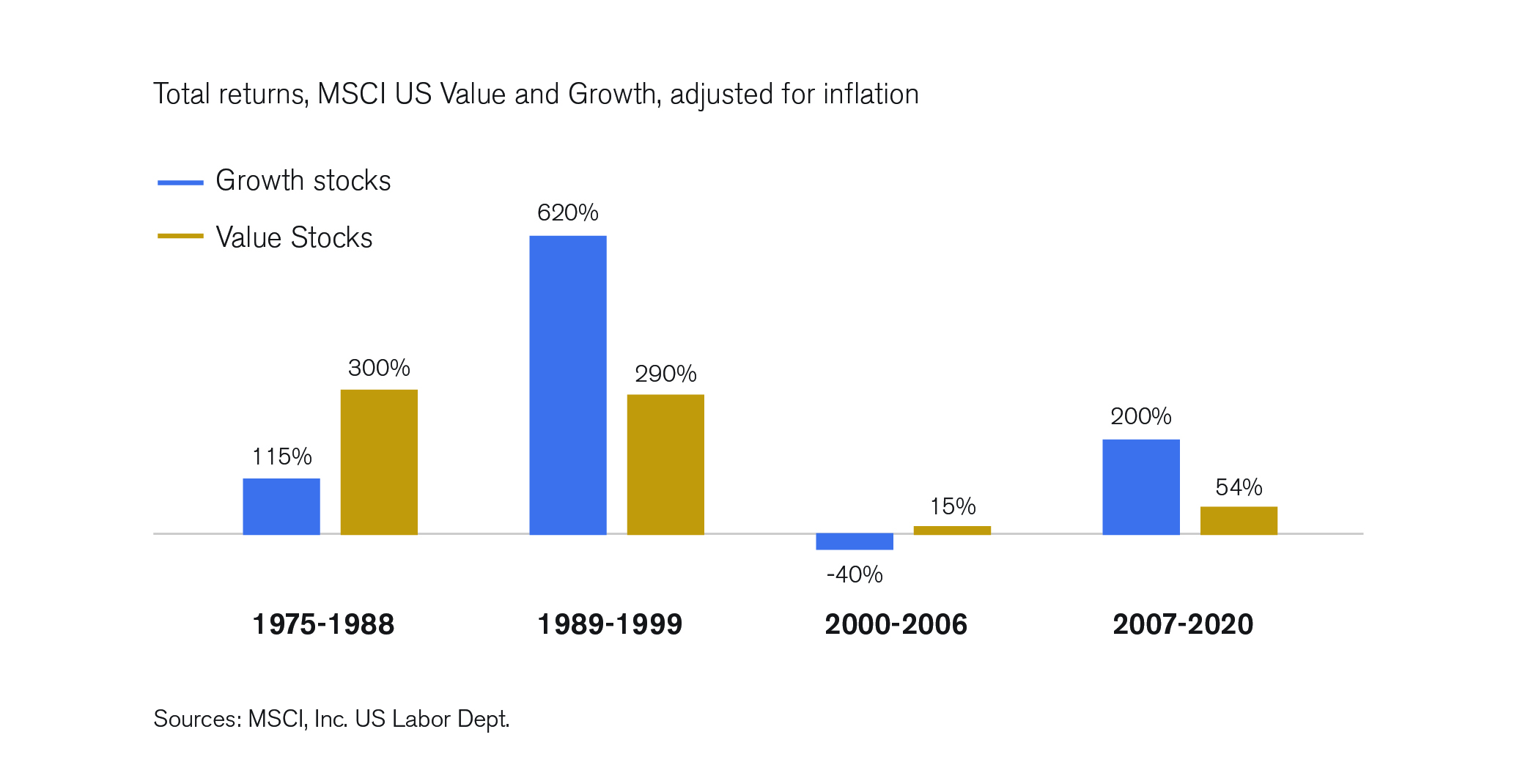

- Regimes don’t last forever – much in the way that investment trends come in and out of favor, there have been several regime changes over the last 40+ years (Exhibit 2). And while Growth has dominated Value since 2007, no one knows when this will shift. Often, it’s determined by price. There comes a point where investors are no longer willing to pay up for an uncertain future. For example, at the height of the tech bubble, CSCO traded for nearly 150x last year’s earnings, while traditional value companies were trading for less than 10x the previous year’s earnings. Growth stocks eventually crumbled under their own weight and it was value’s turn to shine. Sound familiar? While we can’t pinpoint a precise time when a rotation will occur, looking at the past does provide confidence that value has overcome similar problems in the past.

Exhibit 2

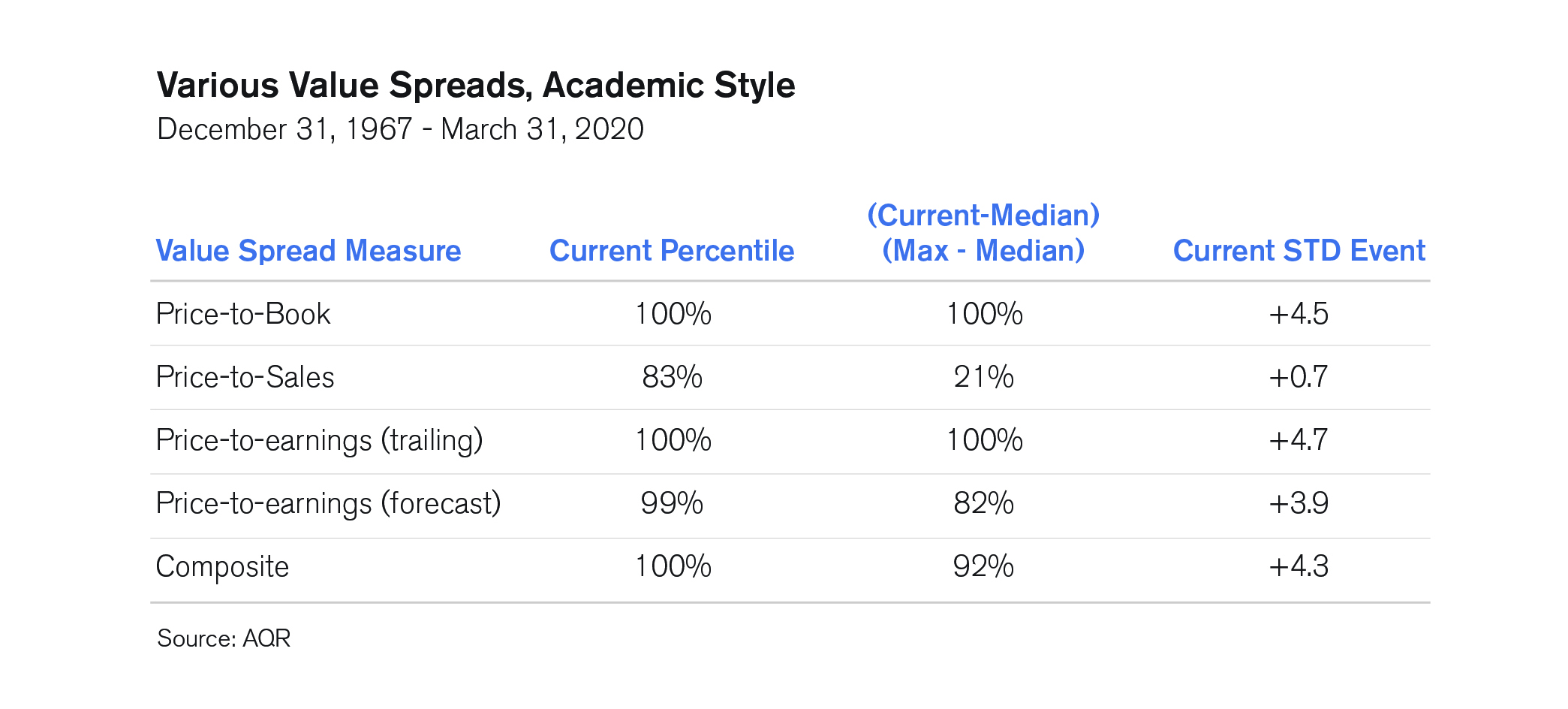

- This time isn’t different – there’s a common argument that traditional value metrics like Price-to-Book (P/B) are less relevant in a day and age where intangible assets (like research and development expenses, brand name, intellectual capital, etc.) that aren’t accounted for by traditional measures, mean more than ever. It’s always dangerous, however, to make the proverbial “this time it’s different” argument; especially when it comes to investing. Before throwing out Value all together, consider that there are alternative ways to compute value that may be more relevant to the modern company – such as using price relative to earnings, cash flow, and/or sales, or even Enterprise Value relative to EBIDTA. By all these metrics, value is extremely inexpensive relative to growth, and using anything but Price/Sales, it’s as close to cheap as it’s ever been (Exhibit 3). As value has underperformed, value stocks have become even more undervalued than usual. Historically, this has led to higher-than-average returns for those stocks going forward.

Exhibit 3: Various Value Metrics

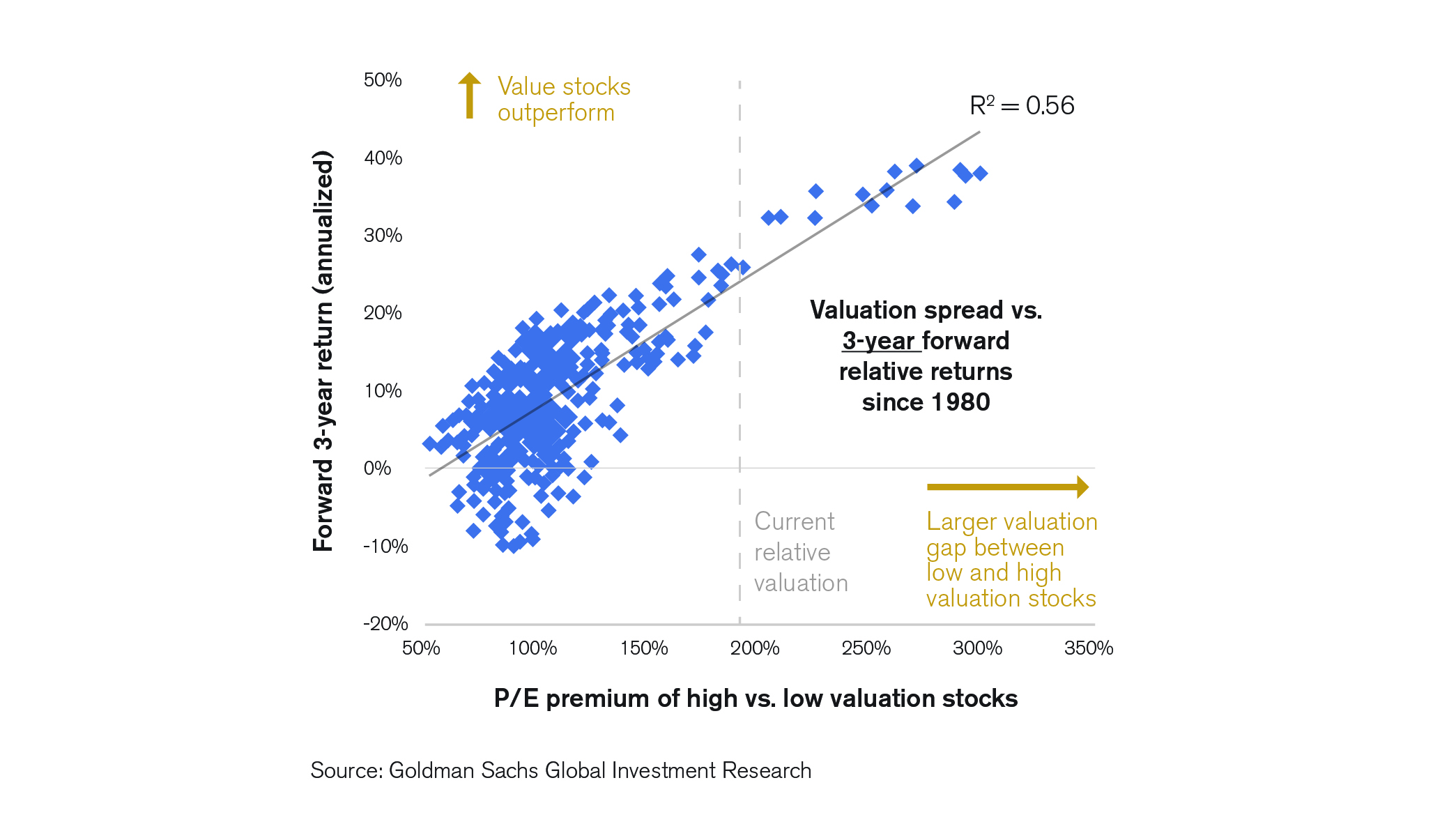

The current valuation gap between the most expensive and least expensive stocks in the S&P 500 is particularly wide today, only exceeded by the peak of the Tech Bubble. In the past, this wide dispersion has been a good signal for future outperformance of the least expensive stocks. While valuation offers no help with timing in the short-term, it has been a strong signal for long-term performance (Exhibit 4).

Exhibit 4: Valuation spread vs 3-year forward relative returns since 1980

- The economic rationale for value still makes sense – let’s be clear: value stocks are cheap for a reason. They typically involve companies that are going through a difficult period and have become less expensive. In some cases, these difficulties will be overwhelming and the companies won’t ever recover. However, on the whole, investors systematically overestimate these problems, extrapolating current realities far into the future. And this leads to opportunities. Investing in value companies certainly involves risk – for which investors historically have been compensated. In the future, we believe investors will continue to be compensated for those incremental risks.

While there is no way to know when (or if) value’s underperformance will end, there are several reasons to stay diversified and stick with an investment plan that includes out-of-favor value stocks. While we believe diversification is an investor’s best friend, it means that there’s always something in your portfolio that is underperforming. Over the last few years, it’s been Value’s turn to underperform and be out-of-favor. However, we remain committed to the belief that over the long-term an investment approach built around broad diversification will help achieve more reliable outcomes for investors.

This material is for informational purposes only and is not intended as individual investment advice or as a recommendation of any particular security, strategy, or investment product. Investment decisions should be made based on the client’s specific financial needs, objectives, goals, time horizon and risk tolerance. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies involve investment risk; Past performance does not guarantee future results. Indices and benchmarks referenced herein are unmanaged and cannot be invested in directly. Investment return will be reduced by the investment advisory fees and any other expenses that the client may incur in the management of an investment advisory account. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SIA, LLC. SIA, LLC is a subsidiary of SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323, and its investment advisory services are offered independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.