By Gene Balas, CFA®

Investment Strategist

The various federal fiscal and monetary stimulus programs enacted to combat the economic shock of the pandemic unleashed a wave of spending before supply chains were fully restored to handle the onslaught. Not surprisingly, the resulting imbalance of supply and demand fueled inflationary pressures.

What’s caught policymakers by surprise, however, is the magnitude, duration, and breadth of those pressures. In addition to choked supply chains, tight labor conditions brought on by greater workforce mobility and exiting/retiring workers have further fanned the inflation flame.

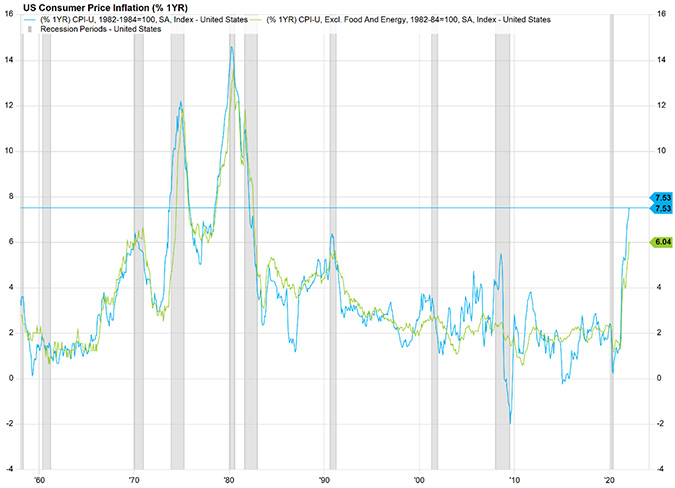

For many consumers, inflation is a substantial hardship. In January, the Consumer Price Index (CPI) rose 7.5% from a year ago—the fastest pace since February 1982.

Source: Bureau of Labor Statistics, FactSet

And based on a deeper analysis of the underlying factors, it’s clear that rather than being driven by one or two historically volatile areas like food or energy prices—this round of inflation is economically broad-based.

You’ve already begun feeling the impact of these price increases at the gas pump, the supermarket, and elsewhere. But what will happen in the future—especially with geopolitical tensions threatening to further disrupt commodity supplies and snarl supply chains—is of even greater interest.

Potential economic impact

Where we are now is indeed a time when the whole world is on high alert—and not just for inflation. Certainly, the Russia-Ukraine geopolitical tensions in and of themselves are extraordinarily challenging, but they also threaten to impact the supply of goods ranging from oil and natural gas to grains and metals (including seldom considered but vital elements like palladium—the vital ingredient in catalytic converters for automobiles).

Russia is one of the world’s largest oil and natural gas producers:

- While oil prices had already been rising, after Russia invaded Ukraine on February 24th, both Brent crude (the global benchmark) and West Texas Intermediate (WTI) (the U.S. benchmark) prices surged even more. Year-to-date, WTI crude oil prices have climbed about 57% to around $120/barrel before receding more recently, and Brent crude has surged by 58%, according to data from FactSet.

- The EU imports nearly half (47%) of its natural gas from Russia—more than double the 21% purchased from Norway, the second-largest supplier. Whether through direct conflict interfering with pipelines that pass through Ukraine or by Russia simply choosing to embargo the sale of natural gas to the EU in response to sanctions, Russian gas flows to Europe could be severely impacted. (Those old enough will recall the economic damage caused by the OPEC oil embargo in the early 1970s).

If Russian flows are cut off, Europe could theoretically import large amounts of liquefied natural gas (LNG) as well as fuel from pipelines linking the continent to Norway, Azerbaijan, and Algeria. According to the Wall Street Journal, it also could release gas held in a strategic reserve in Italy. But making up for a total loss of Russian supplies would be all but impossible—and come at huge expense.

The uneven distribution of LNG terminals in Europe further complicates matters—a third of Europe’s LNG-import capacity sits in Spain and Portugal (according to analysts at S&P Global Platts); another 24% lie within the post-BREXIT U.K. And as sanctions imposed by the West settle in over time, it will likely become increasingly difficult for Moscow to finance, pay for, and transport Russian oil and gas.

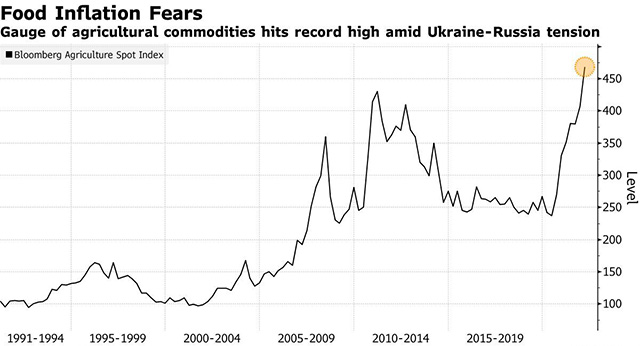

Russia is a major producer of copper and aluminum, and combined with Ukraine, the two nations account for 29% of the global wheat supply. They’re also a leading producer of urea and potash (essential components in fertilizer production). Reductions in the supply of any of these items would likely push food prices higher.

Supply chains are global. We import not only finished goods but also commodities from across Europe (including Russia). But manufacturing any goods in Europe depends on having the resources to be able to produce those products economically—and any increased costs for, say, electricity powered by natural gas, or commodities such as aluminum or palladium, etc. can make those finished goods or components more expensive. This, in turn, would drive inflation higher here as well. Meanwhile, if Europe is forced to import grain from the U.S. to offset Russian supply issues, it creates competition for supply of those products that can drive up food costs here.

Source: Bloomberg

There are also less obvious potential supply chain disruptions. By restricting its sale of palladium to the West, Russia could further impact auto producers that are already struggling to overcome a semiconductor shortage. That can drive up car prices even more – and could further limit the availability of some autos.

How the Fed might respond

While these are all ‘what if’ scenarios, it’s important to remember that what consumers and businesses expect inflation to be in the coming months and years influences their behavior now. It’s why the Fed pays close attention to inflation expectations—and why it may make policy decisions in part to influence those expectations which (as the adjacent chart clearly depicts) are soaring.

Source: University of Michigan

The Fed’s go-to response in these situations is tightening monetary policy— usually by lifting the short-term rates it controls directly, as well as by allowing maturing securities to roll off its balance sheet, both of which, in turn, may drive up longer-term bond yields. The resulting higher interest rates may reduce demand and slow the economy, to help better match demand with the available supply. Higher rates cannot, however, repair supply chains, bring more people back into the labor force, or solve geopolitical dilemmas.

But what if this geopolitical dilemma is enough to damage confidence all by itself and slow the economy on its own—without any restraint from the Fed’s monetary policy actions? Remember what happened when Iraq invaded Kuwait in 1990? Energy prices surged, and consumer confidence tanked from the subsequent war. The result? A recession and a bear market. The Fed needs to guard against tightening too much if the economy already slows on its own due to higher oil prices or a shock to business and consumer confidence. Otherwise, it creates the risk of a policy error.

Geopolitical concerns, rising energy prices, and a falling stock market can all conspire to slow the economy by subconsciously prompting consumers to spend less. And these recent factors may add a wrinkle to the Fed’s plans to simply increase interest rates to control inflation.

Yes, the world has become more complicated of late. But there are still actions you can take today to help offset the potential impacts of inflation and geopolitical uncertainty—setting up your portfolio for future success. Your SEIA advisor can work with you to prepare for a variety of potential outcomes and help keep you on track to your financial goals, whatever they may be.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment; it is a method used to help manage investment risk. Indexes cannot be invested in directly, are unmanaged, and do not incur management fees, costs, and expenses. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit signatureia.com/disclosures.

Signature Investment Advisors, LLC (SIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SIA. SIA is a subsidiary of SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323, and its investment advisory services are offered independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.