Fixed Income Going Forward

By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

With the election over (for the most part), a likely divided government in 2021, and an effective Covid vaccine on the way (hopefully sooner than later), most investors have been heavily focused on the equity side of their portfolio. It’s certainly understandable. The S&P 500® has soared to record highs in recent months. But faced with the reality that bond returns over the next decade will likely be lower than they were the previous decade, investors would be misguided in overlooking the fixed income portion of their portfolios at this time.

Before we get into the past, present, and future for bond investors, let’s recall why we own bonds in the first place. Fixed income assets typically serve two primary purposes:

- Yield: in a well-constructed portfolio, regular interest payments can combine with other income sources like dividends* to provide a valuable income stream

- Diversification: bonds can dampen overall portfolio volatility when held alongside riskier assets such as equities. Investment-grade fixed income assets are not only less volatile but may rise in price when equities fall.**

Looking back

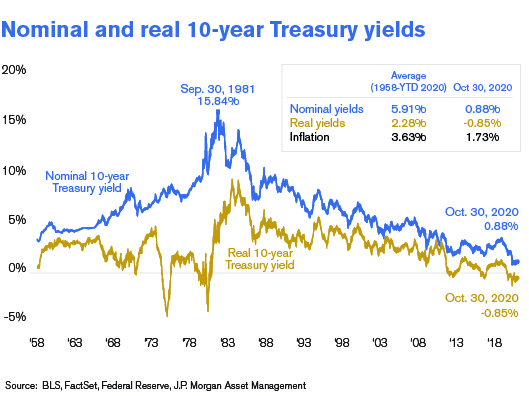

Ever since Federal Reserve Chairman Paul Volcker raised the fed funds rate to 20% back in June of 1981, fixed income assets have been in a secular bull market. While the move caused a recession, it crushed inflation and set up a bull market for stocks that lasted until 2000. During the four decades since Volcker’s move, bond yields have steadily fallen – dropping to almost nothing for benchmark government securities in 2020 (Exhibit 1).

Bond investors have benefited greatly from these long-term trends. In return for taking generally lower credit and equity market risks, Treasury bond investors were handsomely rewarded (with double-digit returns for longer-term bonds) over the last decade. But those returns were largely driven by the steady trend of falling interest rates, combined with a recent flight to safety during the Covid draw-down, and unfortunately don’t appear to be mathematically sustainable over the next decade.

Exhibit 1:

Looking ahead

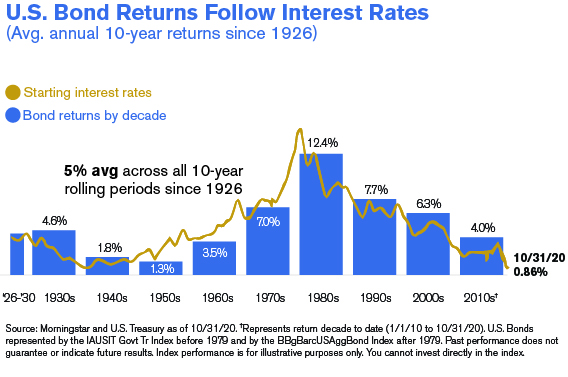

Conveniently, the best predictor of future bond returns is where interest rates are when you start. As illustrated below (Exhibit 2), there’s a clear relationship, and the 2020s are on pace for the lowest returns for bonds since the 1960s.

Exhibit 2:

Outside of the U.S., the picture isn’t any rosier. Near record levels of negative-yielding bonds (with close to $16T of bonds yielding negative rates1) means investors are essentially paying for the privilege of tying up their money for a fixed period of time.

And with forward guidance from central banks like the Fed and the ECB signaling no rate increases for at least 2-3 years, it’s quite possible rates will remain low well into the decade – making things challenging for investors who rely on income from their portfolio.

It might be tempting to react to this new reality by directing assets into areas of the bond market with higher current yields. But caution is necessary, as certain areas are starting to show weakness. In both the investment grade and high yield spaces, leverage is the highest it’s been in a decade, while interest coverage (an indication of the ability of companies to service debt) is heading lower. Additionally, recent years have seen loan covenants (or protections for investors) being stripped away, resulting in more risk.

So what’s an investor to do? In our view, you have two options going forward:

- Reset your expectations lower (at least temporarily). Understand that interest rates are near record lows and thus your fixed income portfolio returns are going to be lower too.

- Expand the opportunity set and be willing to take on more risk in the process.

For those who favor the latter option, two areas worthy of your consideration would be Preferred Stocks and Private Credit Facilities.

Preferred Stock

Preferred stocks are a hybrid asset class with characteristics of both bonds and stocks. Similar to bonds in that they pay a stream of income, preferreds also have certain characteristics of stocks (e.g., they’re subordinated in the capital structure). In the event of a corporate bankruptcy, preferred shareholders would get paid after all other creditors including subordinated or senior unsecured debt but before common stockholders, to the extent possible given the assets available to creditors. To compensate for that risk, they generally pay higher rates of income.

Why do we favor them now? Most U.S. preferreds are bank and insurance company obligations2 – corporations which currently have stronger balance sheets and high asset quality due to mandated regulatory changes in the aftermath of the financial crisis of 2007-2008.

Beyond that, from a tax standpoint, distributions from most preferreds are deemed ‘qualified dividend* income’ and therefore taxed at lower rates than ordinary income. Shifting your portfolio into preferreds removes some investor protections and potential collateral and certainly may come with an increase in volatility relative to a corporate bond, but in our view the pick-up in yield more than compensates for the increased risk, while at the same time reducing inflation and interest rate risk as well.

Private Credit

Another way to expand your opportunity set is through private credit facilities – direct lending to private companies. While this category isn’t often on most investors’ radar, it’s a category comprised of nearly 200,000 companies employing about 52 million people3.

One of the chief reasons this asset class is often overlooked, despite relatively higher returns compared to traditional fixed income, is because of its illiquid and opaque nature. Additionally, just like traditional bonds issued by public corporations, default risk is an important consideration. Because of these risks, we believe it’s an asset class where partnering with the right investment manager is critical.

While bond returns may be challenging going forward, they don’t have to be problematic for your portfolio. As long as you’re willing to reset expectations and consider broadening your toolkit (while understanding the pros and cons of your positioning), you’ll still have an opportunity to meet your income and diversification goals. Your SEIA advisor is here to help you navigate the road ahead.

[1] Bloomberg, as of 8/31/2020

[2] S&P Dow Jones

[3] Cion Investments

*The payment of dividends is not guaranteed. Companies may reduce or eliminate the payment of dividends at any given time.

**Investing involves risk including the potential loss of principal. No investment strategy, including diversification, can guarantee a profit or protect against loss. Past performance is no guarantee of future results.

Although the information has been gathered from sources believed to be reliable, it cannot be guaranteed. Views expressed in this newsletter may not reflect the views of Royal Alliance Associates, Inc. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss. Past performance is no guarantee of future results. Please note that individual situations can vary. Therefore, the information presented here should only be relied upon when coordinated with individual professional advice. Signature Investment Advisors, LLC (SIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SIA. SIA is a subsidiary of SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323, and its investment advisory services are offered independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. does not offer tax or legal advice.