By Gene Balas, CFA®

Investment Strategist

Key Investment Themes for 2024

As we enter 2024, investors face a landscape shaped by various themes. Three particularly noteworthy factors include the challenge of reconciling diverse economic perspectives, the ongoing influence of artificial intelligence (AI) and digital transformations, and the evolving terrain of geopolitical risks. Rather than attempting precise predictions, it may prove valuable for investors to explore the potential outcomes within the uncertainties of these themes, understanding their nuanced impact on the markets.

Reconciling Investors’ Wide Range of Economic Views May Cause Increased Market Volatility

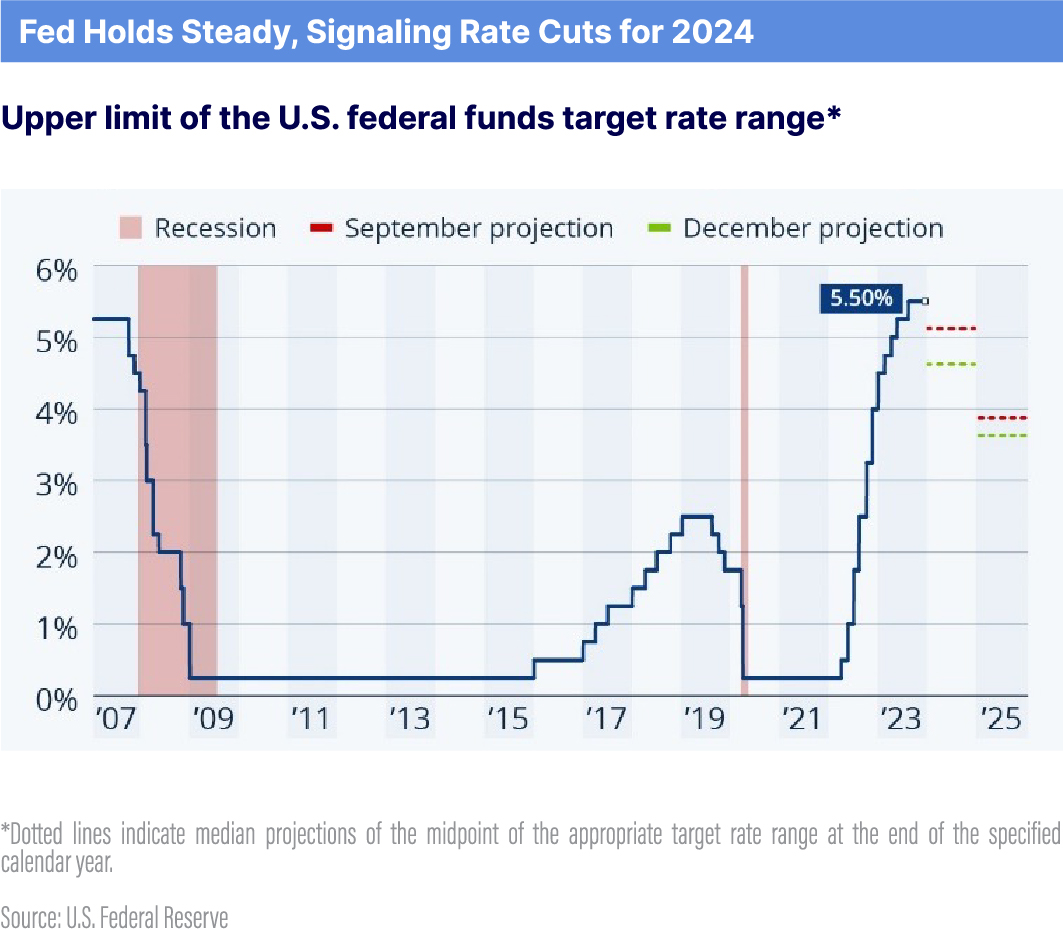

Economists’ views on economic growth and the pace of Fed rate cuts cover a wide range of potential outcomes. Forecasts for stronger-than-consensus economic growth are based on optimism that is partly fueled by the expectation that consumer spending will outdo forecasts, supported by gains in real income and elevated levels of household net worth. Such economists note the labor market is projected to maintain its robustness, featuring an estimated low unemployment rate of 3.6%, while wage growth is set to align with inflation targets. Diminishing inflationary pressure is anticipated to trigger a series of rate cuts by the Federal Reserve, aiming to recalibrate policy rates, such optimists note.

Despite this positivity, there is contrast from some economists who maintain a guarded stance. Concerns center on the risks posed by a potential savings rate rebound and the depletion of excess savings accumulated during the pandemic. These developments could translate into headwinds for the stock market, where heightened valuations and geopolitical uncertainty may become more prominent hazards.

Seeing how these competing views heading into the new year play out may be a source of continued volatility in the markets, especially as the pace of Fed rate cuts – dependent, in turn, on how inflation evolves – is also broadly debated among economists.

The decline in inflation has been uneven. The Consumer Price Index (CPI) inflation report released February 13 showed inflation unexpectedly rose more than market expectations, halting a string of declining rates of price increases. As such, market participants are now aligning their views on the pace of Fed rate cuts with the Fed’s more cautious approach and its hesitance to declare victory over inflation just yet. The Fed is forecasting far fewer rate cuts than the market had been, with the Fed forecasting 75 basis points (bp) (0.75%) in rate cuts in 2024 while the market had expected 150 bp (1.50%).

Reconciling these competing views over the course of the coming year may mean heightened volatility in the markets – especially given that markets are also already arguably pricing in more earnings growth than some economists predict.

Artificial Intelligence (AI) and Digital Transformation

AI is a rapidly growing field with perhaps significant investment potential. This includes investments in leading AI companies as well as businesses involved in supporting infrastructure like hardware and data centers. The transformative impact of AI across sectors like fintech, robotics, and cybersecurity offers a spectrum of investment opportunities, potentially leading to high growth and innovation-driven returns.

A July 12, 2023, CNBC article entitled, “Bill Gates explains why we shouldn’t be afraid of AI” stated that Microsoft cofounder Bill Gates believes artificial intelligence (AI) models like the one at the heart of ChatGPT are the most important advancement in technology since the personal computer.

Furthermore, a study by management consultant Gartner found that 55% of organizations reported increasing investment in generative AI since it surged into the public domain ten months ago. The study noted that generative AI is now on CEOs’ and corporate boards’ agendas as they seek to take advantage of the transformative potential of this technology. However, AI is still at the very start of its evolution and adoption, so investors would be wise to conduct their own due diligence before investing in companies that purport to be developers or users of AI.

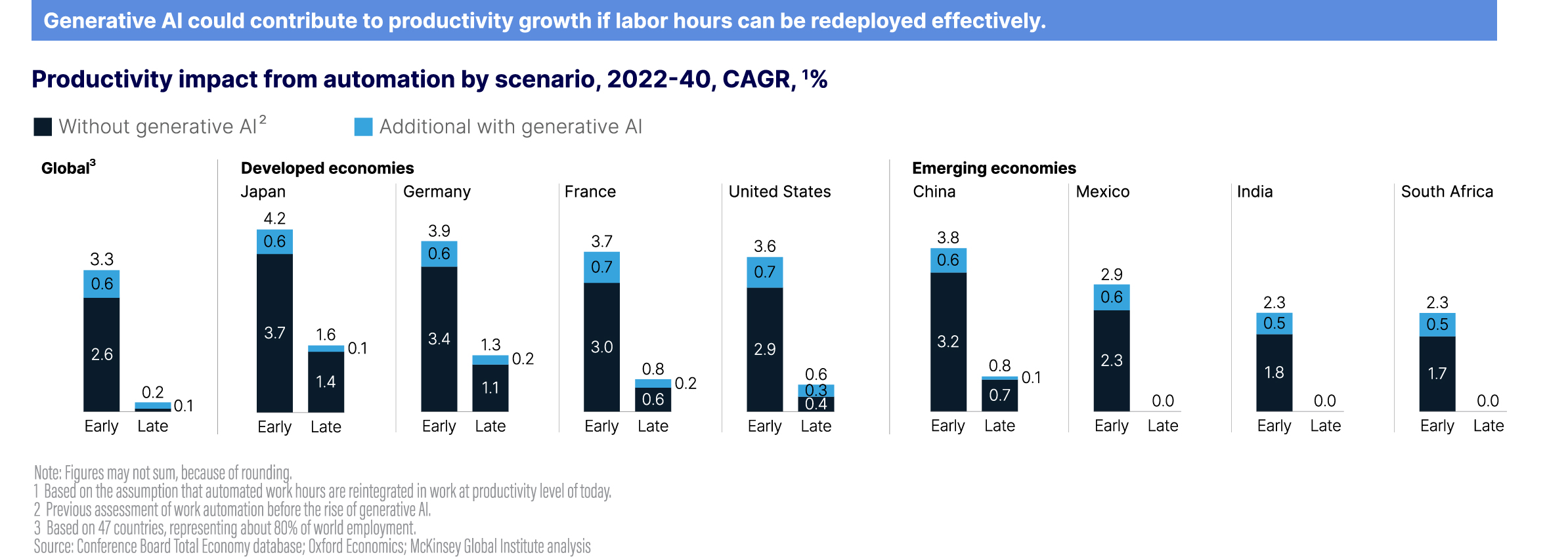

McKinsey & Company, a consultancy, calculated the effects of generative AI – the type of AI that is embedded in ChatGPT, among others – on productivity gains. It used two scenarios of how quickly generative AI would be adopted, the first being adoption within eight years (the “early” period in the nearby graph), and the second being adopted towards the end of a 27 year period (the “late” period). (In reality, the time for adoption would likely be in the middle of the two extremes.) McKinsey also assumed that workers whose jobs changed as a result of this transformation would apply the same labor hours to another role with similar productivity gains as in the baseline assumptions. As seen in the nearby graph, early adoption of generative AI can boost productivity, and therefore, has the potential to increase economic growth, with more muted effects for late adoption.

Investors should also appreciate that there are other types of AI besides generative AI, and there are other transformative technologies, including, but not limited to, robotics, blockchain and cybersecurity, that could be incorporated alongside AI-oriented companies within a diversified portfolio of growing companies that use or develop revolutionary technologies. The importance of cybersecurity, the glue that holds the technologies (both traditional and transformative) puzzle together, should not be underestimated, as Gartner predicts that 45% of all organizations will have experienced attacks on their software supply chains by 2025.

Digital transformation innovations are fundamentally reshaping how businesses operate and interact with their customers. Blockchain technology is revolutionizing transactions and data security, enhancing transparency and efficiency across various sectors. Digital commerce continues its upward trajectory, spurred by innovations in online retailing, mobile commerce, and personalized customer experiences. Investments in these areas are considered strategic, as they tap into new revenue streams and operational efficiencies, offering long-term growth prospects that could enhance the performance of traditional stock portfolios.

Geopolitical Risk and International Investment Opportunities

This theme encapsulates the evolving geopolitical landscape, characterized by heightened risks and uncertainties. Investments are likely to be influenced by factors such as international conflicts, political instability, and global power shifts. With the eyes of the world on the ongoing wars in Ukraine and Gaza, an unprecedented number of potentially major conflicts are going under the radar, analysts have warned.

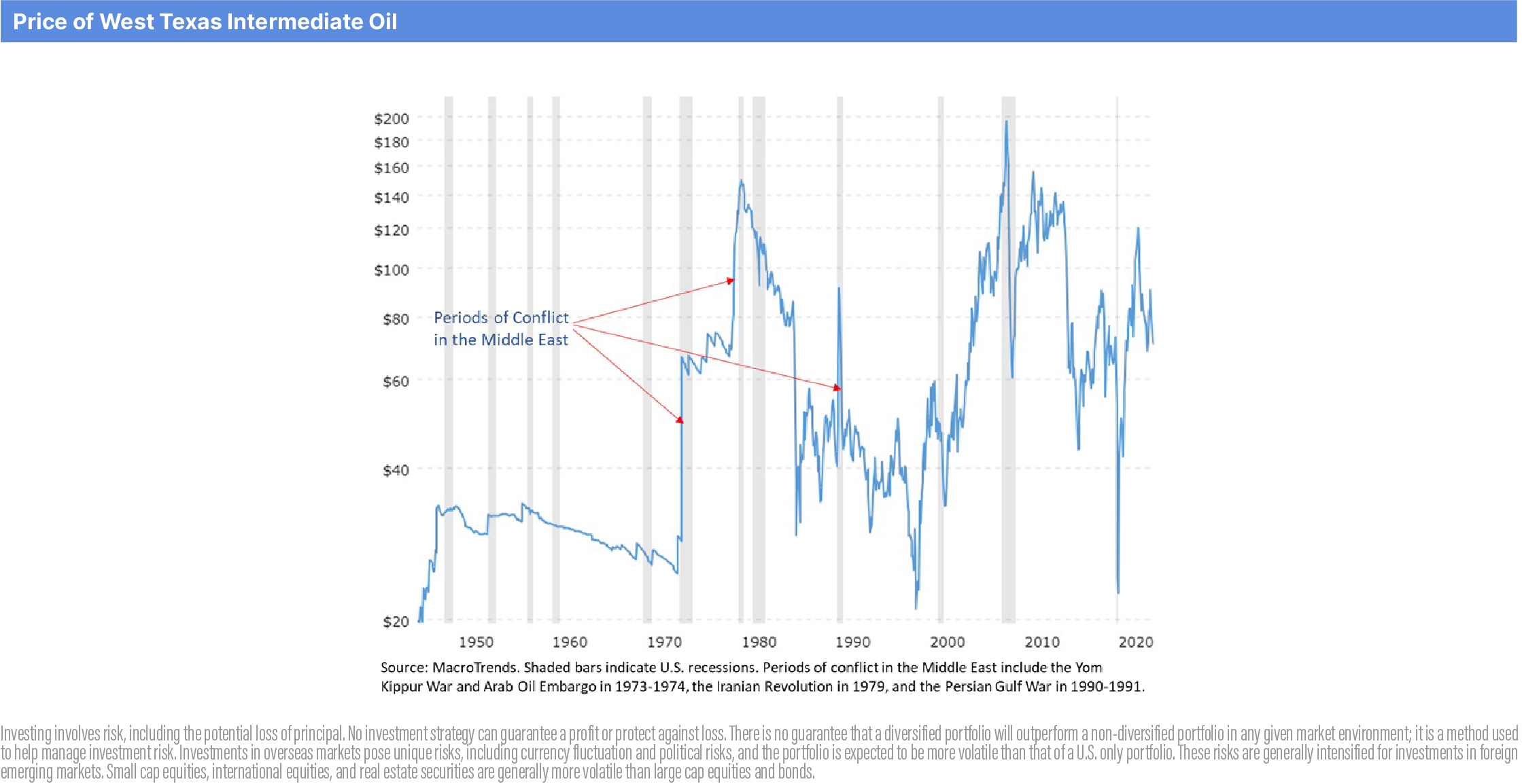

Plus, any conflict in the Middle East in which conflict between Israel and Iran’s proxy agents, including Hezbollah to Israel’s north – where conflict is currently brewing – as well as Hamas, with which Israel is currently at war in Gaza to Israel’s south, along with armed conflict with Houthi rebels in the Red Sea, has the potential to compel other nations, including the U.S., to enter the conflict. This could lead to a sizable increase in the price of oil. Even though the U.S. produces much of the oil domestically that it consumes, the price of oil is set globally and is sensitive to conflicts in the Middle East.

Meanwhile, as the world’s geopolitical risk factors shift, the reshaping of global supply chains is creating new investment opportunities, particularly in emerging markets. Countries like Mexico and India are among those that are expected to benefit from these shifts, according to some economists. These markets may offer attractive investment opportunities as they expand their manufacturing capacities and play larger roles in the global supply chain.

Separately, changes in the value of the U.S. dollar, particularly if it experiences a sell-off, could create investment opportunities in international investments denominated in foreign currencies: if the dollar depreciates against its peers, repatriated values become larger when translated into dollars. Conversely, the dollar’s value can potentially increase with fewer Fed rate cuts and/or greater geopolitical instability.

Conclusion

These three themes bring their own promises and perils, as there is considerable uncertainty as to how each of them will unfold. It is important that investors consider a range of possible outcomes, and ensure that their portfolios are built to withstand these forces, with proper and thoughtful diversification being paramount.

Given that risk is always embedded in the markets, avoiding it completely may not necessarily be prudent: after all, the returns an investor receives are the compensation they receive for taking on some amount of risk. The questions to ask are what types of risk one is willing to undertake, and by how much. In that regard, your advisor is always ready to assist you in helping prepare your portfolio for whatever events transpire.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. The information contained herein is the opinion of SEIA and is subject to change at any time. It is not intended as tax, legal or financial advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek such advice from your professional tax, legal or financial advisor. The content is derived from sources believed to be accurate but not guaranteed to be. For a complete listing of sources please contact SEIA. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is not indicative of future results. Every investment program has the potential for loss as well as gain. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. For details on the professional designations displayed herein, including descriptions, minimum requirements and ongoing education requirements, please visit www.seia.com/disclosures. Securities offered through Signature Estate Securities, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323.